Are You Making These 7 Common Bookkeeping Mistakes That Kill Business Growth?

- seo working

- Sep 11, 2025

- 5 min read

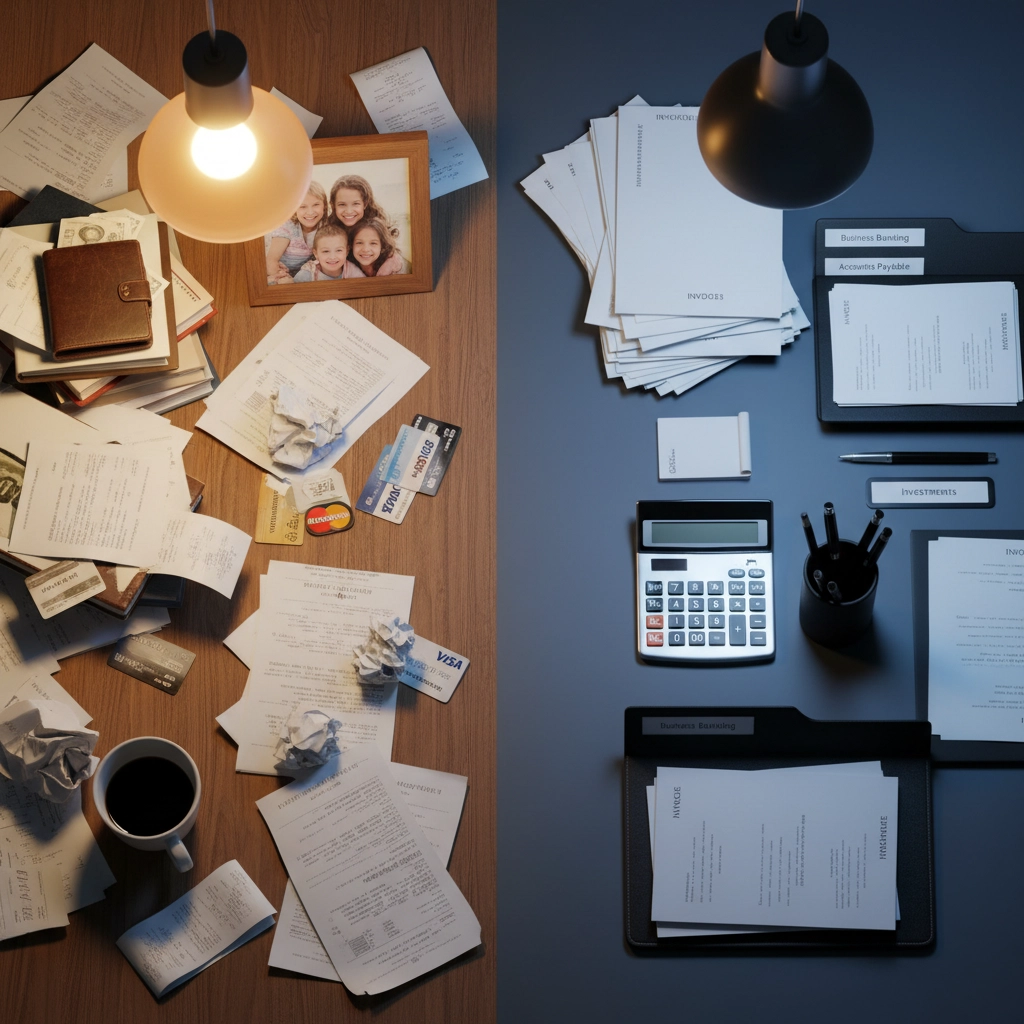

Picture this: you're running a thriving business, sales are climbing, and everything looks rosy on the surface. But behind the scenes, small bookkeeping mistakes are quietly eating away at your profits, blocking access to funding, and creating a financial fog that makes smart business decisions nearly impossible.

If this scenario sounds familiar, you're not alone. Studies show that 82% of small business failures can be traced back to cash flow problems or financial mismanagement, and most of these issues stem from preventable bookkeeping errors.

The good news? Once you know what to look for, these mistakes are entirely fixable. Let's dive into the seven most damaging bookkeeping errors that could be strangling your business growth (and how to fix them before they do real damage).

1. Mixing Personal and Business Finances

This might be the most tempting mistake of all, especially when you're just starting out. You grab lunch with a client and pay with your personal card, or you use the business account to cover your mortgage payment "just this once."

But here's the thing: every time you cross those financial streams, you're making it impossible to see your business's true financial health. How can you make informed decisions about pricing, expenses, or growth investments when your numbers are all tangled up?

The growth killer: Banks and investors need clean financial statements to approve loans or investments. When your personal and business finances are mixed, you can't provide them. Plus, you'll miss out on valuable tax deductions and spend hours (or pay someone else to spend hours) sorting through the mess come tax time.

The fix: Open separate business accounts immediately and use them exclusively for business transactions. If you need to move money between personal and business accounts, do it as a formal owner's draw or capital contribution, and record it properly.

2. Playing Guessing Games with Expense Categories

When you're not sure where to put an expense, it's tempting to just pick the closest category and move on. Software subscription goes under "office supplies," that business dinner gets labeled as "insurance", close enough, right?

Wrong. These small misclassifications add up to create completely distorted financial reports. You might think you're spending too much on office supplies when you're actually investing heavily in technology, or you could miss out on significant meal expense deductions.

The growth killer: Inaccurate expense tracking leads to poor budgeting decisions. You can't optimize your spending or identify cost-saving opportunities when you don't know where your money is actually going. Plus, you'll likely overpay on taxes by missing deductions.

The fix: Create a clear chart of accounts (or have your accountant do it) and stick to it consistently. When in doubt, ask for guidance rather than guessing, it's worth the brief pause to get it right.

3. Skipping Bank Reconciliations

Bank reconciliation sounds about as exciting as watching paint dry, but skipping this monthly task is like ignoring warning lights on your car dashboard. Those duplicate charges, data entry errors, and unauthorized transactions aren't going to fix themselves.

Without regular reconciliations, you're flying blind. Your cash forecasts become unreliable, and you might not notice fraudulent activity until it's caused serious damage.

The growth killer: Inaccurate cash flow projections lead to poor timing on major decisions. You might miss out on growth opportunities because you think you don't have the cash, or worse, overextend yourself based on money that isn't actually there.

The fix: Set aside time each month to compare your internal records with your bank and credit card statements. Yes, it can be tedious, but catching errors early prevents much bigger headaches down the road.

4. Treating Receipts Like Confetti

We've all been there: receipts crammed into wallets, scattered across desks, or lost in the black hole that is your car's cup holder. But every missing receipt represents a lost tax deduction and a gap in your financial records.

Poor record keeping creates a domino effect: you can't claim legitimate business expenses, your financial reports become unreliable, and you waste precious time trying to reconstruct transactions from memory.

The growth killer: Disorganized records make it impossible to provide clean financial statements to potential lenders or investors. They also lead to compliance issues and missed deductions that drain your cash reserves.

The fix: Develop a system for capturing and storing receipts immediately. Whether it's a smartphone app, a dedicated folder, or a cloud-based system, the key is consistency. Train yourself (and your team) to handle receipts properly from day one.

5. Playing Catch-Up Instead of Staying Current

"I'll deal with the books later" is one of the most expensive sentences in business. When you let transactions pile up for weeks or months, you create an overwhelming backlog that becomes harder and harder to tackle.

This reactive approach means you're always looking backwards instead of forward. You can't make informed decisions about your business when you're working with outdated or incomplete information.

The growth killer: By the time you realise there's a problem with cash flow, supplier payments, or profitability trends, it's often too late to course-correct easily. You end up in reactive crisis mode instead of proactive growth mode.

The fix: Set up a regular bookkeeping schedule and stick to it. Even dedicating an hour each week to entering transactions and reviewing reports will keep you ahead of the curve. Consider automation tools to reduce the manual workload.

6. Flying Blind Through Financial Statements

Your financial statements are like your business's vital signs: they tell you everything you need to know about your company's health. But here's a sobering statistic: 60% of small business owners admit they lack knowledge in accounting and financing.

When you don't understand what your profit and loss statement, balance sheet, and cash flow statement are telling you, you miss critical insights about your business performance.

The growth killer: You can't identify trends, spot problems early, or make strategic decisions without understanding your financial reports. This blind spot often leads to cash flow crises that stop growth in its tracks.

The fix: Take time to learn how to read your financial statements, or work with a professional who can explain them in plain English. Focus on key metrics that matter for your industry and business model.

7. Winging It Instead of Following Best Practices

Confidence is great in business, but overconfidence in bookkeeping can be costly. When you're not sure about proper procedures but decide to "figure it out as you go," errors compound quickly.

What seems like a small mistake: incorrectly recording a transaction or missing a filing deadline: can snowball into a year's worth of problematic records that require expensive professional cleanup.

The growth killer: Accumulated errors create financial reports that no one trusts: not banks, not investors, and certainly not you. This lack of reliable financial data makes it nearly impossible to secure funding for growth initiatives.

The fix: Invest in proper bookkeeping education or hire professionals who know what they're doing. The cost of getting it right from the start is always less than the cost of fixing it later.

Breaking the Cycle

These bookkeeping mistakes create a vicious cycle that strangles business growth. Poor financial data leads to bad decisions, which waste resources and miss opportunities. Meanwhile, the time and money spent fixing preventable errors could have been invested in revenue-generating activities.

The solution doesn't have to be overwhelming. You can tackle these issues one at a time, or you can work with professional bookkeeping services that prevent these mistakes from happening in the first place.

Remember, accurate bookkeeping isn't just about compliance: it's about giving yourself the clear financial vision you need to grow your business confidently. When you can trust your numbers, you can make better decisions, secure funding more easily, and focus your energy on what you do best: running your business.

Your business deserves financial clarity, and with the right approach, you can ensure your bookkeeping supports your growth instead of holding it back.

Comments